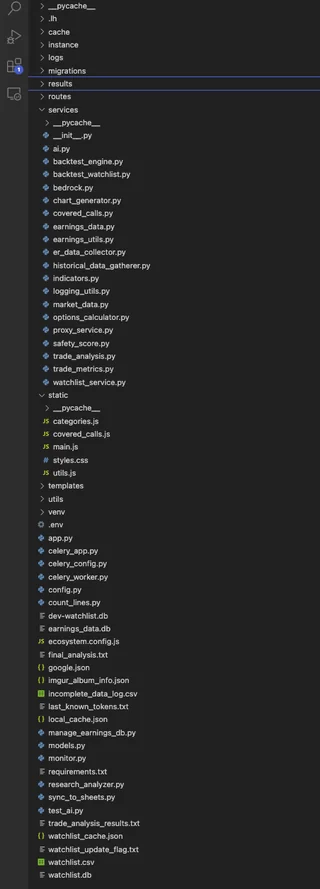

This is a collection of algorithmic trade strategies

You can contribute your strategies here

| Algo Name | Info | Download |

|---|---|---|

| btc trading #1 | I did a backtest of 2 years data with a very simple strategy. I’m new to algotrading can anyone guide me on to what performance indicators should I add to monitor the problems and finally decide the parameters or conditions this bot will run on. |

btc1.zip |

| Automated credit spread options scanner with AI analysis |

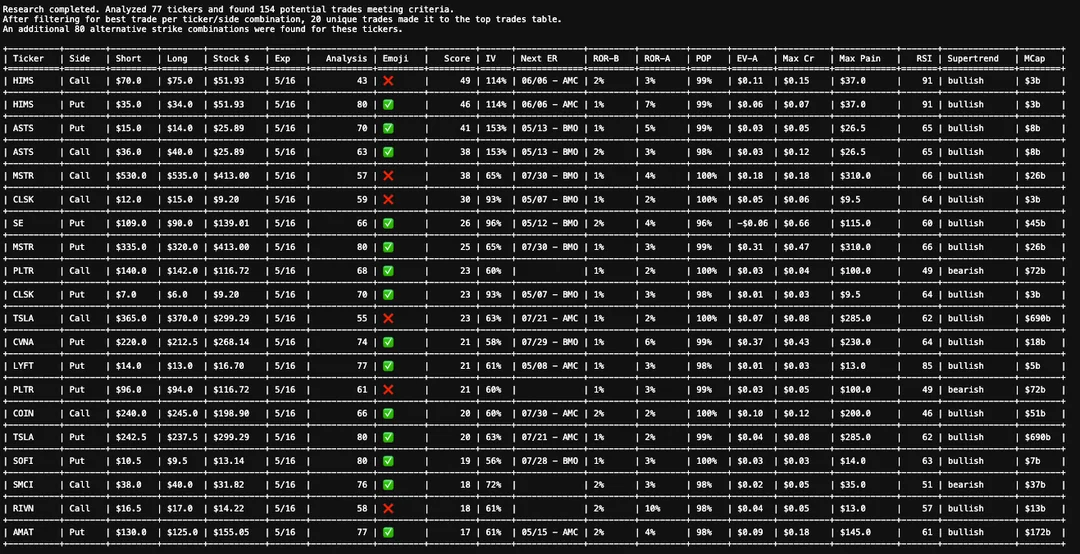

Chart Legend:

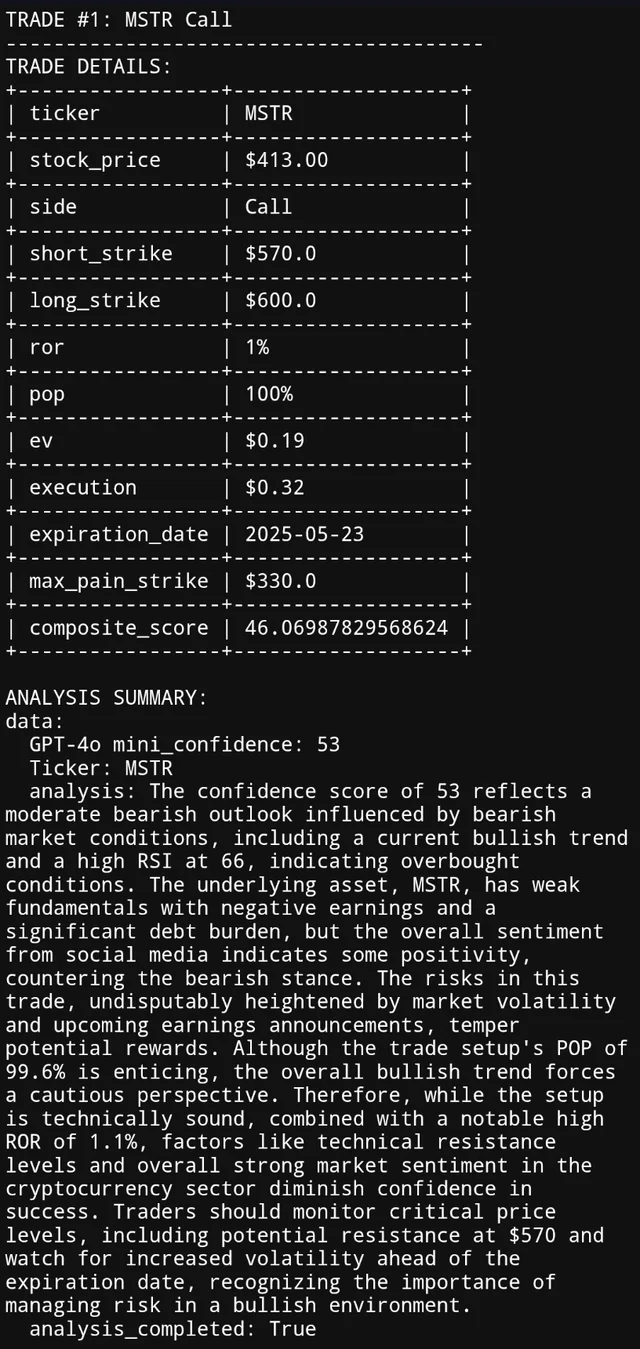

Analysis: Score by ChatGPT on the overall trade after considering various metrics like historical candle data, social media sentiment on stocktwits, news headlines, and reddit, trade metrics, etc.

Emoji: Overall recommendation to take or not to take the trade.

Score: Non AI metric based on relative safety of the trade and max pain theory.

Next ER: Date and time of expected future upcoming earnings report for the company.

ROR-B: Return on risk if trade taken at the bid price. ROR-A: At the ask price. EV: Expected value of the trade. Max Cr: Maximum credit received if trade taken at the ask price.

I've been obsessed with this credit spread trading strategy since I discovered it on WSB a year ago. - https://www.reddit.com/r/wallstreetbets/comments/1bgg3f3/my_almost_invincible_call_credit_spread_strategy/

My interest began as a convoluted spreadsheet with outrageously long formulas, and has now manifested itself as this monster of a program with around 35,000 lines of code.

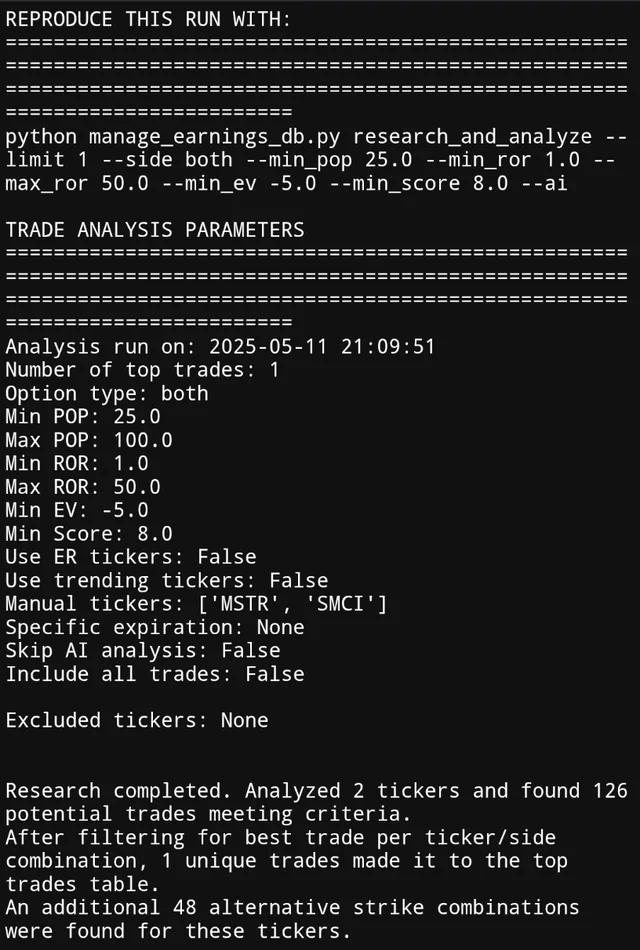

Perusing the options chain of a stock, and looking for viable credit spread opportunities is a chore, and it was my intention with this program to fully automate the discovery and analysis of such trades.

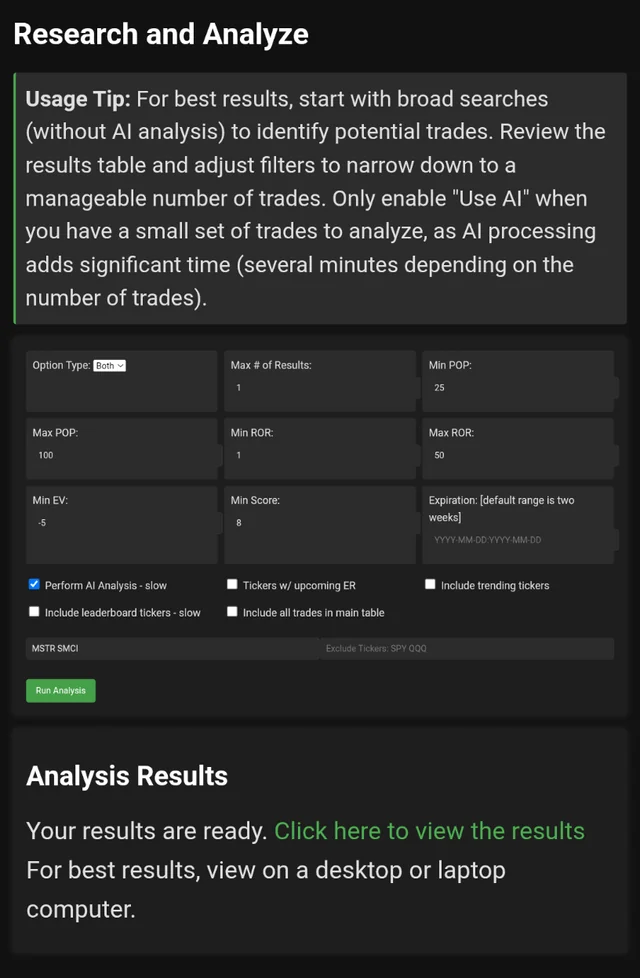

With my application, you can set a list of filtering criteria, and then be returned a list of viable trades based on your filters, along with an AI analysis of each trade if you wish.

In addition to the API connections for live options data and news headlines which are a core feature of the software, my application also maintains a regularly updated database of upcoming ER dates. So on Sunday night, when I'm curious about what companies might be reporting the following week and how to trade them, I can just click on one of my filter check boxes to automatically have a list of those tickers included in my credit spread search.

While I specifically am interested in extremely high probability credit spread opportunities right before earnings, the filters can be modified to instead research and analyze other types of credit spreads with more reasonable ROR and POP values in case the user has a different strategy in mind.

I've have no real format coding experience before this, and sort of choked on about probably $1500 of API AI credits with Anthropic's Claude Sonnet 3.5 in order to complete such a beast of an application.

I don't have any back testing done or long term experience executing recommended trades yet by the system, but hope to try and finally take it more seriously going forward.

Some recent code samples:

https://pastebin.com/raw/5NMcydt9 https://pastebin.com/raw/kycFe7Nc

|

automatedcredit.zip |

| Tradingview backtest |

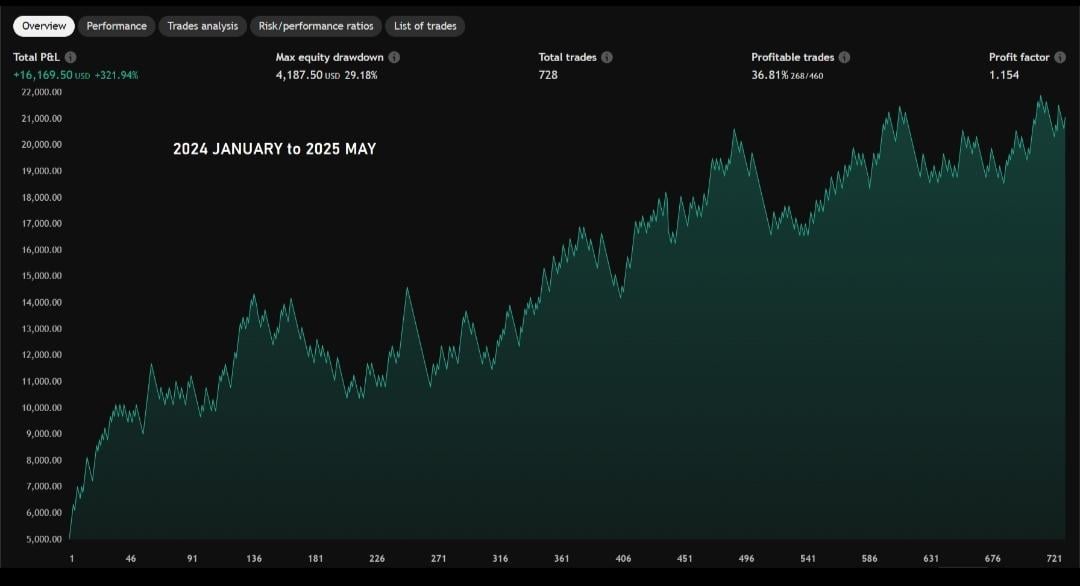

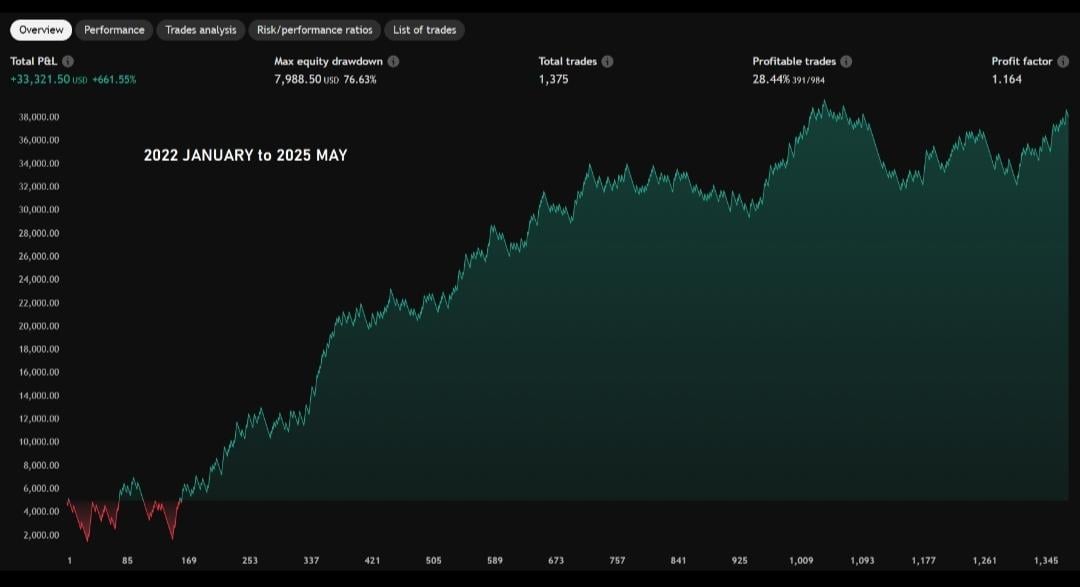

Both of these are backtested on EUR/USD.

The first one works on the 30-minute timeframe (January 2024 to May 2025) and uses a 1:2 risk-to-reward ratio. The second version is backtested on the 4-hour timeframe (January 2022 to May 2025) with a 1:3 risk-to-reward ratio. Neither martingale nor compounding techniques are used. Same take-profit and stop-loss levels are maintained throughout the entire backtesting period. Slippage and brokerage commissions are also factored into the results.

How do I improve this from here as you can see that certain periods in the backtesting session shows noticeable drawdowns and dips. How can I filter out lower-probability or losing trades during these times?

35

|

forexeurusd.zip |

| Algo model library recommendations |

So I have a ML derived model live, with roughly 75% win rate, 1.3 profit factor after fees and sharpe ratio of 1.71. All coded in visual studio code, python. Looking for any quick-win algo ML libraries which could run through my code, or csvs (with appended TAs) to optimise and tweak. I know this is like asking for holy grail here, but who knows, such a thing may exist. |

none |

| Built my own trading bot in Python – sharing tutorial + source code |

I’ve built a trading bot in Python and have had it running on a virtual machine with a demo account for the last couple of months. I struggled to find useful references to help me and it took way longer to figure things out than I expected. So I've made a tutorial video showing how to build a simplified version of it that has all the main functionality like: Fetching live data from API (I used OANDA but have no affiliation to them) Calculating indicators (Kept it simple with EMAs and ATR for stop sizing) Checking strategy conditions for an EMA crossover Automatically placing trades with stop loss and take profit I figure there are others in the sub who would like to make their own bot and aren't sure where to start so I'm sharing the tutorial video and the source code below: |

tradingbot code

video |